What’s New In Insurance Powered By Big Data Analytics And AI?

Say Yes to Big Data Analytics and Artificial Intelligence

Digital disruptions in insurance industry is making the landscape more competitive in the coming future. Data-driven approaches with big data analytics and artificial intelligence are the new norm in every business’ operations, especially in the insurance industry.

Deloitte affirmed that 98% of insurance executives think that cognitive computing will disrupt the insurance industry.

By accepting data-driven strategies and effective decision-making, insurance companies can increase the workforce’s productivity, and gain more profit.

Over the past ten years, innovation and smart applications developed by IT companies around the world have changed the insurance business landscape dramatically.

We have outlined a few applications which are commonly used in the insurance industry now. Expect intricate smart systems and technologies coming in the next ten years which enables higher insurance adoption rates with cheaper and affordable premiums.

![[Blog 500x350].png](https://images.squarespace-cdn.com/content/v1/60b6fd136dae8570d704e0d7/1623996331848-5BTPGEBSTD2BH54JXDHF/%5BBlog+500x350%5D.png?format=500w)

Applications of Big Data Analytics, Workflow Automation, AI and Machine Learning in insurance

Targeted marketing

With big data analytics, insurers now gain insights into their customer’s interests, behavior, needs, and habits, enabling the marketing of relevant products from accurate information. Information can be gathered from multiple sources on the insurer’s sites such as e-mails, social media, user behavior when online, calls, and forums.

This comprehensive understanding of the business’ clientele will build a strong foundation of customer experience, develop relationships, and foster engagement between the customers and sellers. Not only will big data improve customer experience, but it also helps store, access, and manage information for the insurance companies.

Fraud detection

Due to ongoing fraudulent claims in the insurance industry, big data is the solution to overcome these problems. Big data analytics can detect fraud and any criminal activity by managing the company’s data. False claims made against the company will be matched to data in the past.

The system will pause the claim’s processing, and investigations are to proceed to confirm the action. Another form of identifying criminal activities is predictive; big data helps watch the person’s or client’s behavior.

Personalization

Improving the customer’s experience is just as important as gaining insights into their interests. Now that big data is used daily to gather data from different sources insurers can understand the customer’s preferences and build personalized offers explicitly based on the target group.

Big data also gives insurers a chance to produce innovative products or services.

Exastax, an insurance company that focuses on healthcare, has adopted apps and wearable devices that collect data like the customer’s health conditions and chronic diseases by proactively tracking them.

BMC Public Health conducted a study to find 2/3 of Americans are willing to take on health insurance wellness programs that may require wearable devices. With health being highly valued, now may be a good time for insurers to release innovative products for the customer’s experience while promoting healthcare.

Reduce claims processing time

An insurer’s success has always depended on the claims processing; being fast and efficient is the key. If humans were to be the ones who check data from medical reports, photos of damaged items, police reports, etc., the process would be time-consuming, slow, and produce high chances of human errors. Delays in these situations may cost the company loss of customers and repetitional damage.

These are solvable by using workflow automation that helps with streamlining claims-related processing and operations. And according to WorkFusion, the automation of claims processing can reduce 80% of manual work and reduce 50% of the time taken for the processes, allowing insurance companies to process claims two times more than before.

Complicated and repetitive tasks for insurance companies now are dramatically reduced with the help of big data technologies. As intelligent automation is available, insurers will save time and money with machine learning assistance that trains data to do predictive analysis and develop algorithms.

AI-assisted insurance advisors

Insurance agencies are data-rich, so implementing artificial intelligence and machine learning will improve their consistency and efficiency in business development for the agency clientele.

Machine learning constructs part of artificial intelligence and is in the lead of that field; it teaches computers to think and learn like humans from data. As customers come and go, visiting sites, and are looking for answers customer services are expected to perform efficiently and provide personalized solutions, which is why artificial intelligence exists to replace humans as chatbots to review each customer’s profile and recommend relevant products based on their criteria or preferences.

These chatbots have natural language processing (NLP), artificial intelligence, and machine learning features incorporated into them to analyze, communicate, and assess the users like how a human would do so.

Accenture stated that 74% of consumers would not mind computer-generated insurance advice, and 78% of customers would listen to investment advice given by virtual assistance.

The roles of traditional insurance agents will transform to integrate chatbots as a part of the touchpoints for prospecting to product recommendation and finally closing the sales.

Independent insurance agents and brokers who tap into the technology will drive higher conversions and loyalty if they implement AI-assisted technologies along their value chain.

Non-insurance corporations partner with traditional insurance companies as the industry grows digital.

1) Transportation x Insurance (Grab and Chubb)

In the past five years, the insurance industry has introduced technology into its products, as seen in insurance plans and programs promoting wearable devices. The growth of insurance technology (InsurTech), an extension from financial technology (FinTech), has given more technological solutions, better customer services, and innovative, personalized products in the local market.

An example of a partnership offering insurances using technology to their advantage is between Grab and Chubb.

Grab is a Singaporean FinTech startup company and leading company in Southeast Asia’s transportation industry, and Chubb – founded in 1882- is a global insurance provider operating in 54 different territories and countries. With their partnership, Grab’s platform has data technology, inclusive of predictive analysis and machine learning, that can personalize insurance solutions offered to Grab’s drivers.

The companies aim to improve lives in Southeast Asia, particularly for the driver’s welfare, as they are the “heart of our vision,” said the managing director of GrabPay Southeast Asia. Income from hard work can be difficult to secure with their livelihoods to protect as well; that is why this partnership has created app-based insurance products with support from Chubb’s expertise on insurance.

Who and what can be covered?

On Grab’s website, the following are available to drivers to select their preferred insurance plans:

- Main Insured Only

- Main Insured + Spouse

- Main Insured + Family

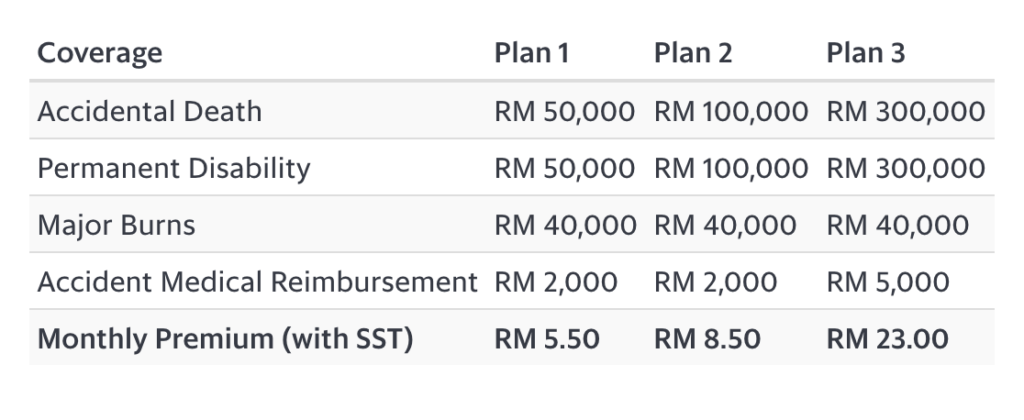

You are covered by paying as low as RM5.50 per month if an accidental death were to occur, receive third-degree burns, and more.

An example from Grab’s website of the ‘Main Insured Only’ plans:

The results of this partnership and the utilization of advanced technologies were an increase of 32% more income for Grab’s driver-partners on a per hour basis. Grab has also managed to invest in their support function, events for the community, which could help with marketing their company or insurance products, and in-app tools to improve customer services and experiences.

2) Human Resource x InsurTech (Kakitangan.com and Fi Life)

Kakitangan.com is a platform that digitizes the human resource department processes to streamline the management of people, payroll, and more.

Fi Life is the largest term life insurance provider online in Malaysia. Both of the brands collaborated to offer unique products to employees in the Kakitangan.com ecosystem.

Kakitangan.com‘s goal is to expand on their employee’s benefits offerings, which aligns with Fi Life‘s purpose – to protect the livelihood and health of employees. Their partnership has created direct life protection for those under Kakitangan.com’s payroll; if employees decide to leave the company, Fi Life’s protection is still applicable.

Users of Kakitangan.com’s web app can obtain personalized quotes based on their smoking status, age, and sex.

Do you notice that there is no insurance agent or intermediaries involved in the entire process from buying and selling? The platform itself has emerged from the pure human resources features with more value-added services.

The market will see more system integration, which might threaten the traditional insurance agencies in the long run. Insurance agencies should find innovative business ideas and solutions to tap into the new opportunities posed by digital innovation.

3) E-Wallet x FinTech (Boost and Aspirasi Protect)

Aspirasi is a micro-financing and micro-insurance company for Micro Small Medium Enterprises under Axiata umbrella of companies.

Within the Axiata ecosystem, the Boost app is one of the growing e-wallet app with rewarding features for its community.

The partnership aimed to expand Boost‘s offerings by developing an e-wallet with easy access, affordable insurance coverage, and customizable micro-insurance solutions. The micro-insurance plans were created for Malaysians “Aspirasi Protect” released by Boost’s e-wallet and Aspirasi, their digital financing platform, underwritten by Great Eastern Life.

During financial difficulties, the first subscription to drop is insurance for most people. The partnership enables Malaysians to access to a wide variety of bite-sized insurance policies from as low as RM 1.50. With this initiative, hopefully, the insurance protection gap in Malaysia can be addressed.

4) Telecommunications x Insurance (Digi and AXA AFFIN Life Insurance)

The collaboration between Digi and AXA AFFIN Life Insurance has produced an insurance product that became Malaysia’s first-ever prepaid internet plan packaged with free life insurance cover developed to protect customers without paying additional financial commitments.

With only RM28 per package, the limited edition Digi Prepaid package is preloaded with a life insurance cover of up to RM40,000 for death, accidental death, and funeral expenses, providing customers protection at no additional cost.

This innovative proposition allows customers to access protection with the internet while staying at home due to the presence of COVID-19.

5) AutomotiveTech x Insurance (KATSANA and several Insurers)

Katsana is a data company focusing on connected cars, telematics, and usage-based insurance with over 1 billion km in analyzed travel distance. (Source: Pagan Research)

KATSANA has collaborated with some insurers, namely: Allianz Malaysia, Axiata Business Services, Etiqa Insurance, and Etiqa Takaful, to create a product that integrates usage-based insurance (UBI) into the development. This collaboration aims to improve road behaviors by rewarding those who drive safely with a reduction of insurance premiums while delivering a high-quality customer experience without selling expensive telematic devices.

In 2017, ‘DriveMark‘ was launched. It is an on-road safety mobile app and an independent collector, gathering profile data from insurers and data on the consumer’s driving behavior through cohort analysis. After the launch of DriveMark, 9,000 people were recorded to be using this product. This figure is expected to increase due to the new social feature, allowing users and their family members to keep track of each other’s driving behaviors.

The future of motor insurance is set to change as the adoption rate of mobile technology like DriveMark grows. When everything is connected, it is possible to see a reduction in the cost of insurance while increasing the profitability of insurers.

Be at the frontier in the insurance industry by embracing top in-demand digital technologies.

In the next generation insurance value chain, data, analytics, and artificial intelligence will be the fundamental ecosystem where the process of product development, marketing, underwriting, customer services, claims management, financing, and operations are integrated.

Those who do not adopt big data and artificial intelligence will not be able to keep up with the advancements of technology in the future. Having and gaining talents in data science, analytics, and AI skills will give you a better chance to innovate.

The Center of Applied Data Science is offering a 10% discount to MII members for any training and development courses for insurance professionals.

Find out more at our website or contact the Malaysia Institute of Insurance for more info.